Posted on: February 1st, 2019

If a few million dollars—or more—fell into your lap tomorrow, what would you do?

Sudden wealth isn’t a common or reliable way to get rich. Most significant wealth results from considerable efforts made over a long period of time. But there are exceptions.

Indeed, significant wealth sometimes happens very fast—and may not even require breaking a sweat. Some big drivers of sudden wealth include:

Sounds great, right? But while sudden wealth may sound like a dream come true for many of us, it’s often accompanied by serious challenges resulting from the “sudden” aspect of that money. With sudden wealth, everything about being rich—the good and the bad—happens at once. In contrast, most people who build wealth slowly are able to address issues and concerns incrementally over time.

The result: Sudden wealth can be an emotionally charged and overwhelming experience. Sometimes there are emotional challenges because of the source of the money—a relative who died, for example. Feelings of panic or guilt can go hand in hand with the feelings of excitement. All those swirling emotions can cause recipients of sudden wealth to make bad—sometimes exceptionally bad—decisions about the money and about their lives.

Here’s a look at how you—or someone you care about, such as your children—can prepare to deal with sudden wealth effectively to realize amazing opportunities while avoiding the many pitfalls of “striking it rich.”

To be sure, getting rich quickly can solve many financial problems. You can pay off debts that have been weighing on you, improve your medical care and never again worry about affording the things you need.

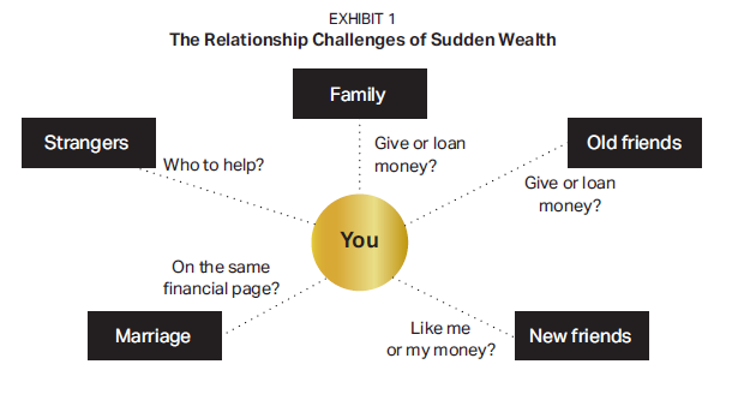

At the same time, getting rich quickly can create big problems in your relationships with other people—including the people in your life you care about most (see Exhibit 1).

Sudden wealth can also impact new relationships. Are new friends—and, especially, new potential romantic partners—interested in you, or your money? If it’s well-known that you’ve become wealthy, there is a high probability that strangers will approach you asking for money. Sometimes it will be for a very worthwhile cause—but it is quite possible it is just a scam.

What’s more, people who experience sudden wealth can fall into several traps that can quickly erode or eliminate those assets. These wealth destroyers can impact anyone, of course, but we see them hit the suddenly wealthy especially often.

If you give too much of your wealth away, you can end up in a precarious financial position faster than you might imagine. Even loaning money can prove problematic and occasionally disastrous. Most times, there are not any mechanisms (such as collateral) in place to ensure repayment.

When some people get a windfall, they spend wildly. There is nothing wrong with treating yourself well and enjoying a good life. But if the money needs to last a long time, excessive spending can jeopardize your financial future. The key is to balance needs and objectives with wants.

Action step: Create a wish list and then prioritize the following.

If you receive a windfall, there will be a lot of professionals seeking to help you manage your money and address your planning needs (such as for an estate plan). That’s especially true if your sudden wealth has been made public, increasing your profile in your community. There is a high probability that many of these professionals are going to be “Pretenders” who aim to do a good job but are simply not talented enough to help you. Some may be “Predators”—actual criminals seeking to illegally separate you from your wealth. Then there are the “Exploiters” who want to take advantage of you using legal but dangerous or risky approaches.

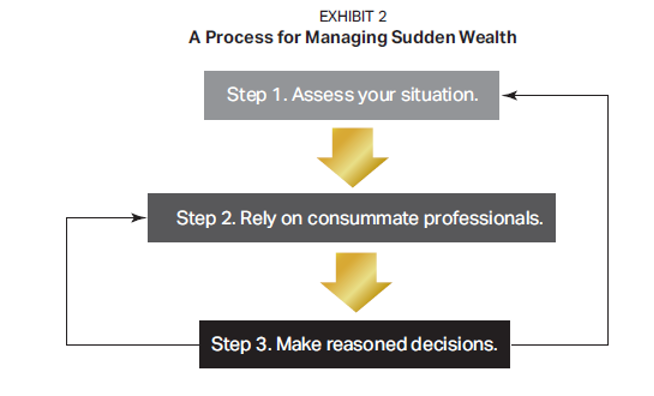

You want to work with consummate professionals—experts who sincerely care about you. These professionals are recognized authorities. They understand the difficulties you face due to becoming suddenly wealthy and are able to help you chart a financial course that matches your needs and wants. Consummate professionals can also act as a sounding board when it comes to most aspects of dealing with your newfound wealth.

Your sudden wealth can make you a target for unscrupulous litigants. One way to address this possibility is by safeguarding your assets. By working with a wealth manager who is well-versed in asset protection planning, you can potentially insulate yourself from deceitful and ruthless litigants—legally.

As noted, sometimes sudden wealth leads to marital friction. When this becomes really bad, it can lead to divorce, which can significantly erode that windfall. If you become suddenly wealthy before you’re married, strategies like prenuptial agreements should be considered. If you are already married when you become suddenly wealthy, the actions available to you may be more limited.

If you or a loved one is fortunate enough to become suddenly wealthy, here’s a process we recommend that can help you or the other person get prepared and set up for success (see Exhibit 2).

Important: Part of this assessment should be understanding your limitations. Where do you need help in dealing with the assets?

Contact your financial professional to discuss any issues or concerns you might have around sudden wealth—your own concerns or those of any heirs.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.