Posted on: July 1st, 2020

As someone looking to make smart decisions about your money, one of your main goals should be to ensure you’re getting value from the professionals—wealth managers, lawyers and accountants—you rely on for guidance.

The following quiz is a great way to get started.

Use the following scale to rate the accuracy of each of the following nine statements.

Not at all accurate Extremely accurate

1 2 3 4 5 6 7 8 9 10

_____ The professionals I’m using really understand me as a person (including my hopes and dreams, concerns and anxieties).

_____ The professionals are very good at explaining complex concepts, ideas, opportunities and solutions to me and to others.

_____ I have a sincere and trusting relationship with the professionals I’m working with.

_____ The professionals I’m working with are consistently able to access best-of-class expertise and solutions.

_____ The professionals I’m working with invariably are able to attain the expertise I need and want on an expedited and exceptionally cost-effective basis.

_____ Because of the professionals I’m working with, I’m able to “jump the line” when it comes to getting the solutions I need and want.

_____ The professionals I’m working with are constantly taking steps to catch and correct any mistakes or potential problems with what we are doing or are considering doing.

_____ The professionals I’m working with regularly employ “What if?” thinking to identify possibilities and opportunities in order to determine the very best courses of action.

_____ The professionals I’m working with make sure I’m staying on track and following the best possible course of action, or they determine whether an alternative would be more appropriate and effective.

Each 1, 2 or 3 answer means that an important element of your working arrangement with these critical professionals is far from optimal. It can be useful to think of these answers as colored red.

A 4, 5, 6 or 7 answer often means that the element is in progress but your professionals could do better; think of those answers as yellow.

The 8, 9 and 10 answers indicate that the professionals you rely on are where you want them to be, so consider them green.

If all your answers are red—which we believe is highly unlikely—think of it as a tremendous opportunity to dramatically improve your relationships and your financial life. Ask yourself what it might mean if you could rate every statement an 8, 9 or 10:

Clearly, it would be both nice and advantageous to have all of our answers in that coveted “green zone” space.

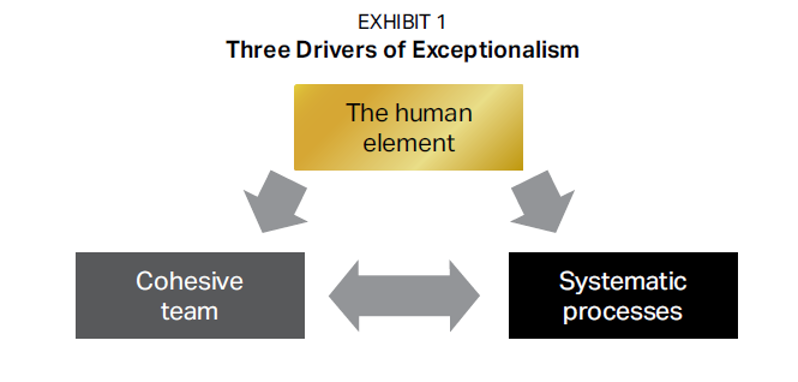

Achieving an optimal financial world is often a function of three drivers: the human element, a cohesive team and systematic processes (see Exhibit 1).

These drivers are fundamental to all types of professional relationships and tend to be very characteristic of the relationships we see between top professionals and highly successful clients and families.

Let’s examine each one more closely.

This powerful driver is essential because it addresses the quality of the relationship you have with the professionals you engage. In our experience, the way to consistently get great results is to work with professionals who truly and deeply understand you—and who are able to communicate with you in a way that truly resonates with you.

When the human element is strong, the professionals you work with know who you are and what matters to you (as well as what doesn’t matter!). Only by being so in tune are they able to coordinate solutions that best serve your specific needs and wants.

A strong human element also means professionals know how to frame their messaging and recommendations so you understand them to the level required to make informed choices. Without understanding you and being able to communicate with you very effectively, it is virtually impossible for a professional to conceive of and deliver the very best solutions.

Bottom line: If the professionals you are working with are attuned to the human element, the first three statements in the evaluation tool above will be green.

When it comes to your financial world, it is extraordinarily unlikely that one single professional can do everything you need and want. In our experience, no one possesses the full range of expertise that affluent clients require. That’s why we believe you need a strongly motivated team of experts.

But it takes more than just a roster of professionals. Those professionals need to be able to work together seamlessly on your behalf. That’s the “cohesive” part of the equation. Referrals to other experts are good—but what can really make the difference is when all the experts are brought together to work collaboratively and creatively on your behalf. When that happens, there is typically one professional—often a wealth manager or an accountant—who coordinates the team and the process of working together.

Establishing and coordinating a cohesive team is hard work, but it can be a key driver of getting the best possible outcomes.

Bottom line: If the professionals you are working with are able to put together and coordinate a cohesive team, the second three statements in the evaluation tool will be green.

Some professionals deal with their clients in a haphazard, disjointed manner—an approach that makes it impossible to get optimal results. On the other hand, there are proven methodologies to ensure that you get ideal, integrated results. When you have a professional adeptly coordinating the efforts of other experts on your behalf and doing so based on proven methodologies, you can enhance the likelihood of achieving the best synergistic outcomes.

One such systematic process is stress testing. This is a process that is being employed by more and more advisors to ensure that any errors in planning or strategies are rapidly corrected and any important opportunities are captured. The power of stress testing is so significant that it is being adopted by a wide variety of affluent individuals and families.

Additionally, a variation on stress testing can enable the professionals you work with to make certain that your situation is continually improving. This entails ongoing monitoring of meaningful changes happening in your life and the lives of your loved ones, as well as changes occurring in the private wealth industry and related industries. It also involves rapidly responding to financial innovations as they occur.

Bottom line: If the professionals you are working with use systematic processes to engage with you and your finances, the final three statements in the evaluation tool will be green.

As you’re probably well aware, not all professionals possess and leverage these three drivers of exceptionalism. Those professionals are more limited in what they can accomplish for you, your loved ones and the causes that matter to you.

Our advice: Strive for excellence by identifying and working with professionals who see the importance of being exceptional—and who have the resources in place to actually be exceptional on your behalf. It’s one of the best ways we know to pursue optimal financial outcomes—now and in the years to come.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.