Posted on: April 1st, 2019

We know we can learn strategies for success from the world’s Super Rich—people with a net worth of $500 million or more. But it can also make good sense to look beyond those wealthy individuals and families to a group of key people in their lives: the financial professionals who serve them.

In particular, the senior executives who run the Super Rich’s single-family offices (SFOs) can give all of us valuable clues about how to ramp up our own success and wealth. To understand why, consider who these senior executives are:

The message is clear: If you are a business owner, an executive or another key decision-maker, you should start learning what these SFO senior executives are up to. Chances are, you can probably benefit from knowing some of their key success traits and habits. Armed with information about the steps they take to achieve great success, you can set out to emulate them in your own life, career or business.

One strongly positive quality we find among SFO senior executives—the one that seems to underpin their ability to do so well for their clients and for their own bottom lines—is their willingness to share with and learn from others like them. Indeed, peer-sharing and networking along with formal group learning and collaboration are key differentiators that help fuel excellence among these professionals.

Consider, for example, that more than four out of five—83.9 percent of—senior executives at single-family offices seek to enhance their networking proficiencies and better connect with their peers.

There are many ways they are creating and building these professional connections. Two of the most effective traditional methods are:

Action step: If you’re not already part of the top membership groups in your industry, it’s time to step into that stream. Given the competitive challenges in virtually every sector, membership in industry-specific groups and attendance at key events with power players in your niche can provide you with important advantages.

Action step: Have intimate lunches or special meetings with top peers or other experts who you feel could be tremendously valuable to you. Get as much one-on-one or small group time with them as you can in these environments.

One really exciting growing trend we see among SFO senior executives is participation in elite mastermind groups. The reason is simple: The underlying (and often explicit) value proposition of elite mastermind groups is greater business success with the strong possibility of becoming personally wealthy.

In a worldwide survey of 356 SFO senior executives, about one-fifth are involved in elite mastermind groups. Just about all ultra-wealthy families with single-family offices are expecting more and more from management and are willing to invest in top-quality management. With the proven effectiveness of excellent mastermind groups, they will likely become increasingly attractive to family office senior executives.

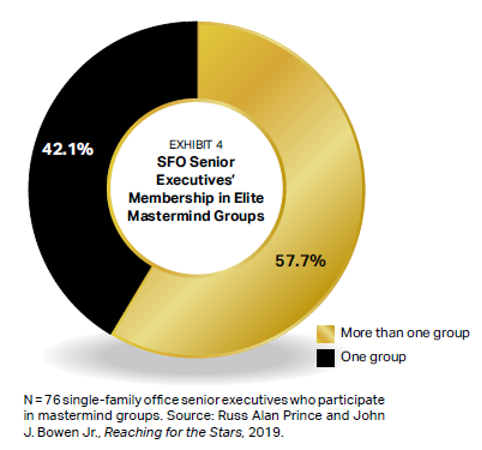

Elite mastermind groups’ value is especially evident when we consider that nearly 60 percent of the SFO senior executives who participate in them say they have joined more than one such group (see Exhibit 4).

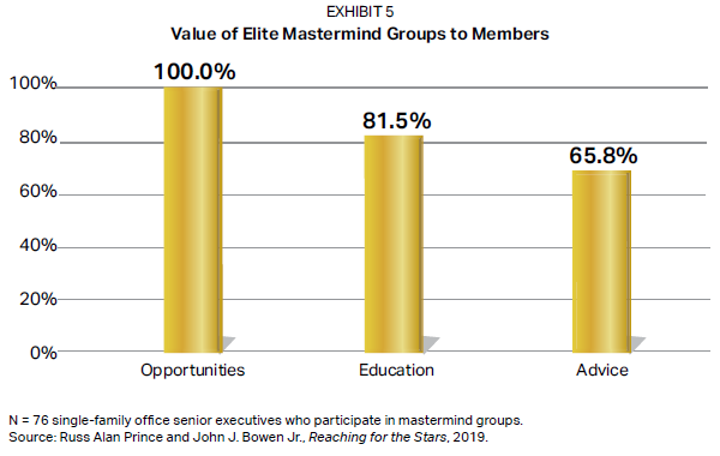

So how, exactly, do elite mastermind groups provide significant value to entrepreneurs? For SFO senior executives, the value of elite mastermind groups is principally threefold (see Exhibit 5).

The broader implications of these findings are clear: Most business owners need a community of people to help them get to the top. That’s true of the top entrepreneurs we know and work with, and it’s true in our own cases as well. Mastermind groups can create that community of friends, peers and mentors—including other entrepreneurs—who can offer support and guidance when they’re needed most, as well as access to growth opportunities.

If you want to be among the best, it’s nearly always helpful to learn all you can from the people who are already standing in the winner’s circle. Top SFO senior executives—who earn big incomes by delivering tremendous value to Super Rich clients—can be ideal role models for entrepreneurs, executives and others who strive for excellence and seek to build serious wealth.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.