Posted on: February 2nd, 2018

The Super Rich (those with a net worth of $500 million or more) who have a family office typically engage a sizable lineup of professional advisors to help them create and implement financial plans. To ensure those plans are both state-of-the-art and in line with their needs and wants, many of the Super Rich regularly “stress test” these plans.

Here’s why you should join them in that effort—even if you’re not nearly as wealthy.

Stress testing your financial plan can be a very smart way to help make certain that the plan will deliver as promised. The fact is, financial plans that might look great on paper all too often prove to be much less impactful once they are implemented. It is not uncommon for there to be unintended consequences that can even derail your agenda.

At heart, stress testing is when you ask, “What if…?” about a variety of areas of a financial plan you have or are considering. You probably conduct the same type of exercise in your business when considering options for your next product launch, expansion and so on.

When it comes to estate planning, for instance, a wealthy individual might ask questions like:

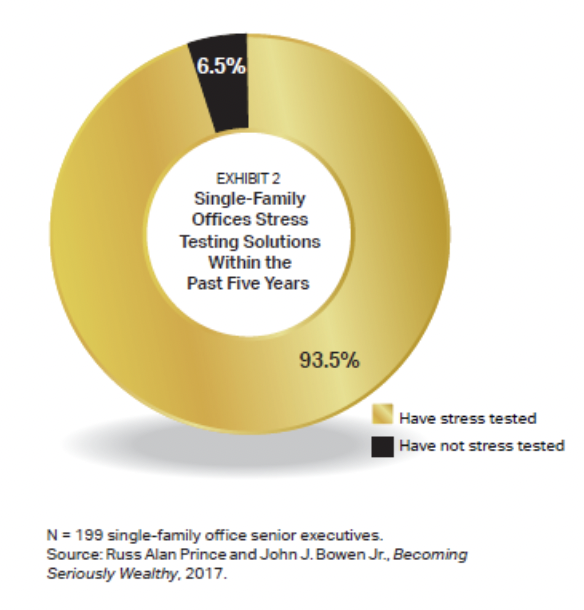

Stress testing is a very powerful form of a second opinion—and getting second opinions is very characteristic of successful family offices. More than nine out of ten single-family office senior executives we surveyed had stress tested financial services and products they were considering for their affluent family clients over the past five years (see Exhibit 2).

The impact of these stress tests on the financial lives of the Super Rich has been powerful:

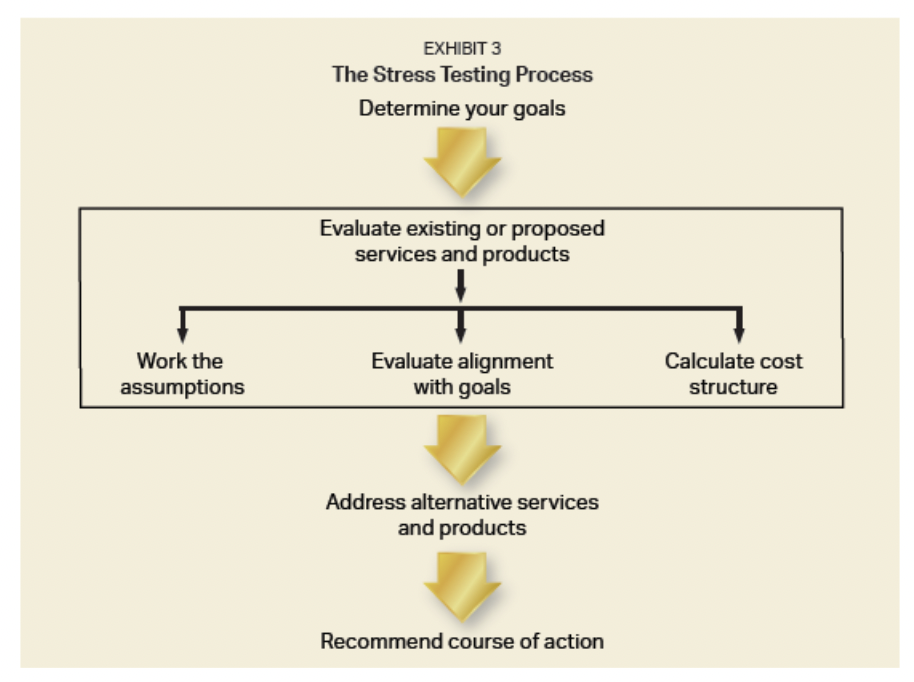

To be effective and informative, stress testing should be done in a systematic manner. While there are some variations, the basic process starts by determining the individual’s or family’s goals and objectives (see Exhibit 3). The goals being sought, the problems to be solved and the opportunities to benefit from should be the driving forces behind the choice of financial and legal solutions.

Once the goals and objectives are clearly understood, the specific existing or proposed financial services or products can be evaluated. There are numerous ways to dissect and critically assess financial services and products:

Based on the stress test’s evaluation of the existing or proposed solutions, alternative products or services might be considered. It can be very useful to do side-by-side comparisons between such alternatives and the solutions being considered or currently used, asking questions like:

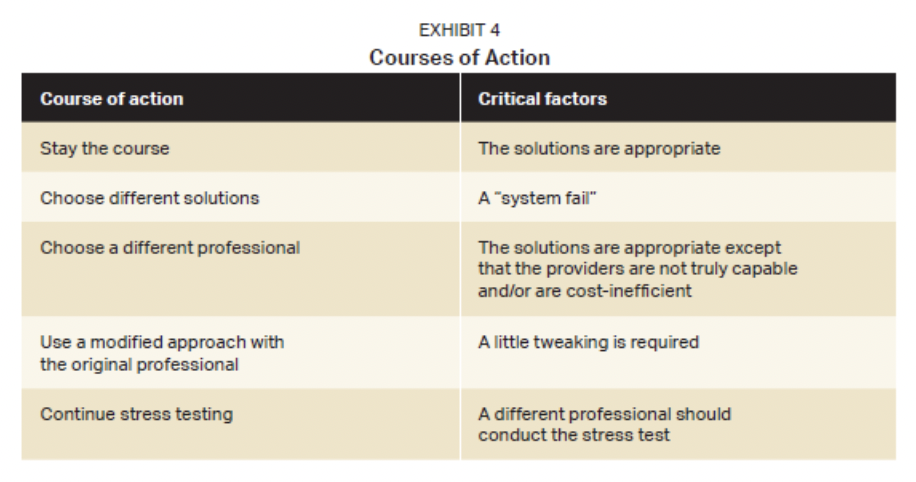

The end result of the process: recommendations. Based on those recommendations, there are five courses of action to consider taking (see Exhibit 4).

Although stress tests are commonly used among the Super Rich, they should be a part of most people’s due diligence process when vetting financial plans, products and services. Frequently, stress tests uncover flaws in financial plans as well as better ways to achieve desired outcomes. For those reasons, stress tests will likely benefit a great number of people—especially business owners and their families, who generally have so much of their future financial security riding on one asset: their business.

Certainly there is a cost to stress testing estate, asset protection and income tax plans. That cost will depend greatly on the complexity of the testing involved and the family’s situation. However, in our experience, a stress test fee can be a whole lot cheaper than the costs—financially but also emotionally and psychologically—of a plan or solution that is fundamentally flawed or in conflict with your goals.

If you are curious about whether a financial product or service you have—or are considering—will work the way it is supposed to under various conditions, you might benefit from a stress test.

Our recommendation: If you think this strategy may help you achieve your goals, contact your financial or legal professional.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.