Posted on: August 1st, 2021

People purchase life insurance for lots of reasons—the most common often being to take care of their loved ones. The life insurance proceeds are used either to create an estate for those left behind, or to pay taxes so the family receives the estate. Still others might use life insurance to maximize income (such as by supercharging a retirement plan) or to address business concerns (as in the form of providing company benefits).

But did you know you can potentially use life insurance to leave a charitable legacy?

It’s true. Life insurance can be an effective way to help the causes you care about by providing the payout from a policy to a charitable organization. Typically, the life insurance death benefit will significantly exceed the premiums paid for the life insurance policy—thus allowing you to make a much larger gift than might otherwise be possible.

Here’s a look at how it works.

The use of life insurance to fund a charitable organization might appeal to you if, for example, you find that you don’t have beneficiaries who are in need of the money from the policy.

The biggest advantage of donating a life insurance policy is probably leverage; it is a way to increase the size of a charitable gift. In many cases, it is also a way for donors to receive a greater tax deduction than they’d receive donating cash.

Both term and permanent life insurance policies can be donated to charity. However, permanent insurance is typically used for donations because it’s not in force for only a certain number of years (as is the case with term life). This way, the gift will eventually be made even if the donors live very long lives. Another advantage of using a permanent life insurance policy: The charitable organization can surrender the policy for cash if it owns the policy before the donor dies.

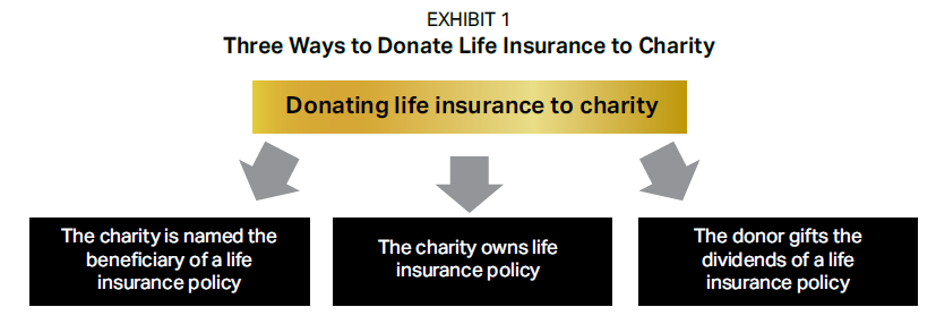

There are a number of ways you can donate a life insurance policy to charity. These different approaches have different tax implications for you as the donor (see Exhibit 1). Therefore, it’s usually a good idea to seek the advice of a tax professional when making donations of life insurance policies.

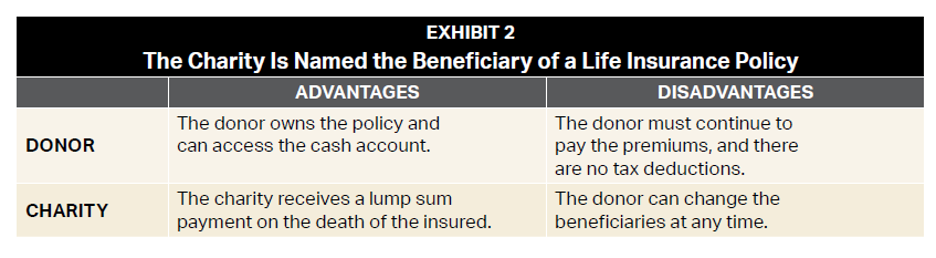

When you name the charity as the beneficiary, the charity gets the death benefit when you (as the donor) die. This is not an all-or-none scenario, though. You can name multiple beneficiaries, such as a number of loved ones and one or more charitable organizations. You name the charity a beneficiary by purchasing a new life insurance policy or adding the charity as a beneficiary on an existing policy.

Important: In many situations, with an existing life insurance policy, it is fairly easy to change or add beneficiaries. However, some life insurance companies can limit the option of making a charity a beneficiary.

The advantages and disadvantages of this approach are shown in Exhibit 2.

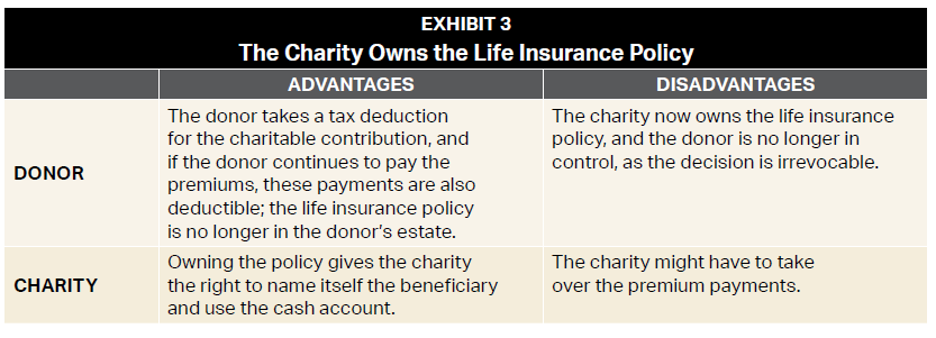

Alternatively, you (as the donor) can make the charity the owner of a life insurance policy—a strategy that can generate tax deductions for you. This move also gets the insurance policy out of your estate for tax purposes. The downside: Once the charity owns the policy, you’re no longer in control of it—and the decision is an irrevocable one.

This can be done with a new policy or an existing one. In both cases, the charity is named the beneficiary and receives the death benefit when the insured dies.

In the case of a permanent life insurance policy, a charity that owns the policy might not have to wait until the death of the insured to receive money. Instead, the charity can potentially use the money accumulating in the policy. Also, if there are funds in the cash account, there is the possibility of surrendering the life insurance policy for the cash value.

The advantages and disadvantages of this approach are shown in Exhibit 3.

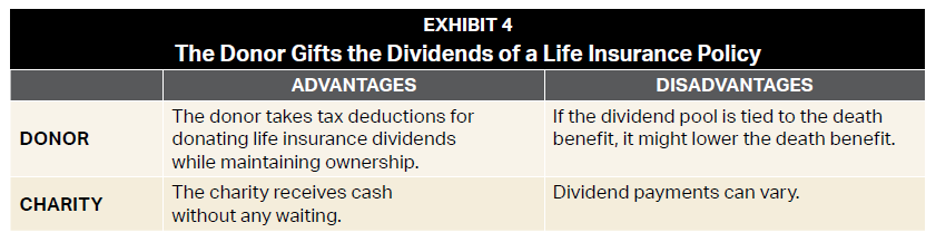

With permanent life insurance policies that provide dividends, you as the donor could use dividends that have built up in the policy to make charitable donations. These contributions are tax deductible. You, as owner, control the life insurance policy, and the charity is not a beneficiary.

The advantages and disadvantages of this approach are shown in Exhibit 4.

When making any gifts to charity—especially gifts that involve financial products and legal structures—it can be wise to consult with a tax or wealth management professional. This will better enable you to understand your options and help ensure you are making a decision that is right for you and your particular situation.

That said, don’t automatically let tax considerations be the determining factors in giving to charity. The prime motivation for philanthropy should always be to do good. Keep in mind that even with the tax benefits, you are still giving away some of your wealth. The idea is ultimately to support worthwhile causes in the most tax-effective way possible.

So don’t overlook this option. In the end, you might discover that life insurance is a great way to leave a charitable legacy and benefit financially.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.