Posted on: October 2nd, 2019

The goal of many successful entrepreneurs is to sell their companies for top dollar—maybe in the near future, maybe decades from now. Successful sales not only validate owners’ skills and hard work, but also tend to make entrepreneurs a whole lot wealthier than ever before.

Unfortunately, many of those entrepreneurs may be in for a rude awakening. The fact is, far too many entrepreneurs these days—even some who are trying to be proactive and get set up for success down the road—are not prepared to get the most out of selling their companies. The reason: They haven’t taken a few key steps that can position them for the outcomes they most want.

As a result, they risk leaving money on the table—a lot of it, potentially—and walking away with far less wealth for themselves and their families than they could have if they had only planned smarter.

One major step that gets overlooked is putting a formal transition plan in place for transferring ownership of a business. A formal transition plan is carefully designed to proactively and optimally structure a company (and its people) for the firm’s eventual sale to new owners. Done well, a transition plan can maximize all aspects of a transition—from the sale price to the health and continuity of the company itself and its key people.

With that in mind, here’s a look at how to put in place a transition plan that can empower owners to accomplish three goals:

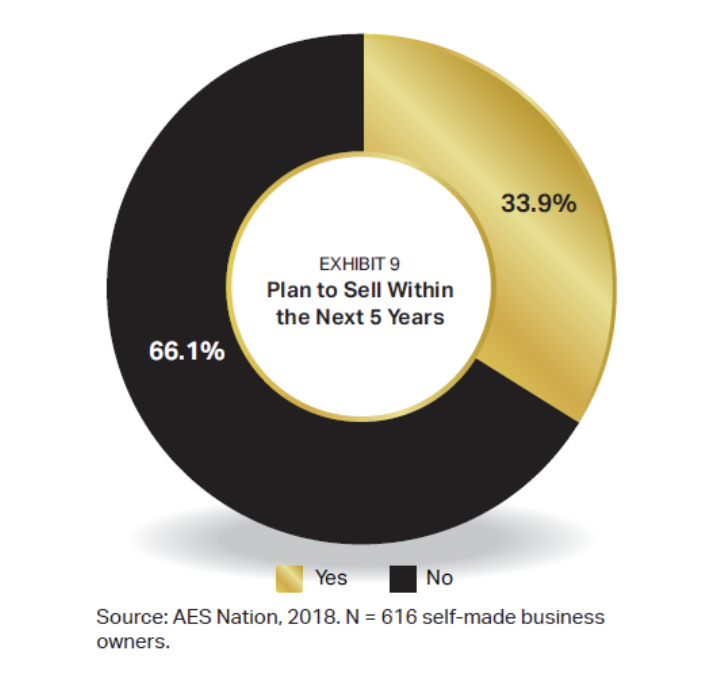

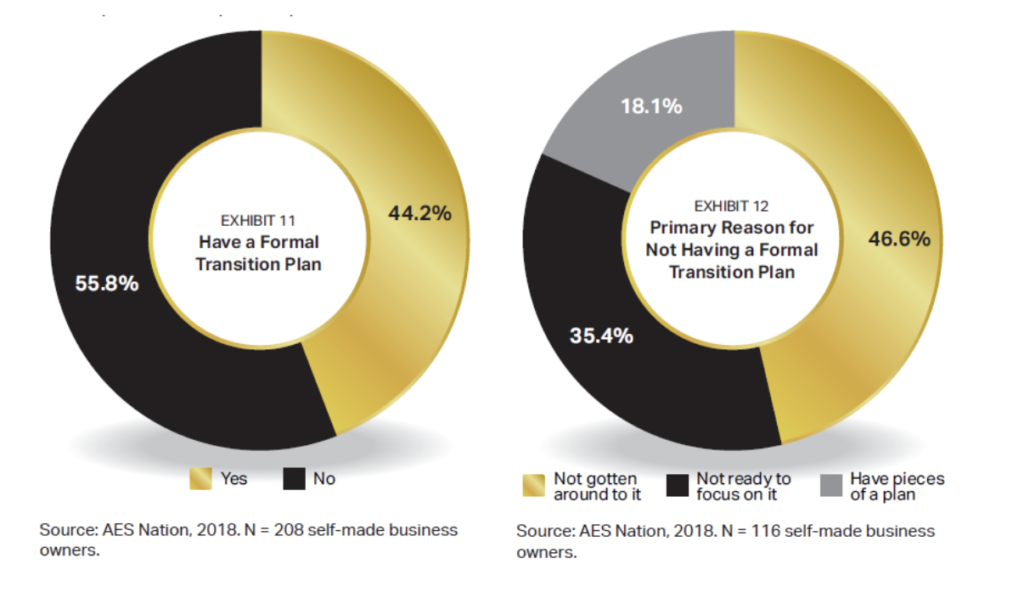

These days, many business owners are thinking about moving on to the next stage of their lives. In a survey of 616 self-made successful business owners, one-third said they are looking to sell their companies within the next five years (see Exhibit 9).

Their main reason: They anticipate getting a very good price in the current economic environment (see Exhibit 10). Other important drivers include rising competitive pressures, more difficulty running the business and changes in their industry. A full one-fifth of these business owners simply want to retire.

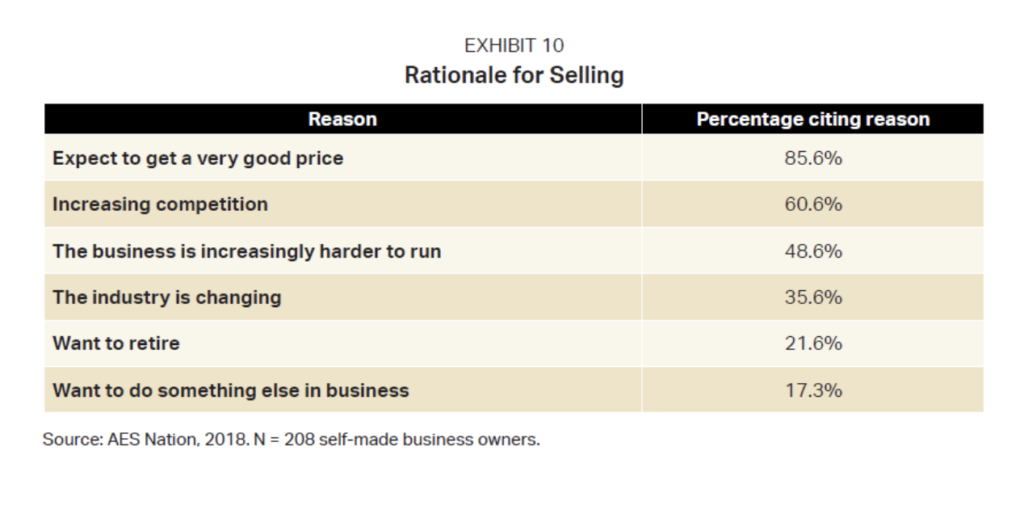

Despite being highly motivated to sell in the near future, these business owners generally don’t have a formal plan in place to transition their businesses from themselves to a new owner (or owners). As seen in Exhibit 11, more than half lack such a plan.

If selling their company is so important to them, why do so many entrepreneurs lack a detailed plan for making it happen? Nearly half said they simply hadn’t gotten around to it (see Exhibit 12). A little more than one-third of the owners reported they were not ready to focus on it. (In somewhat more encouraging news, 18 percent said they had some pieces of a comprehensive plan in place.)

These owners may very well be setting themselves up to fail—and end up either not being able to sell their companies or walking away from a sale with far less wealth than they may deserve. While most of these business owners are not approaching the sale in a systematic and thoughtful way, even the ones who do have some pieces of a plan in place aren’t where they need to be.

To see the importance of comprehensive transition plans, consider some of the key steps that the 44 percent of surveyed business owners who do have such plans in place are taking. Their actions can serve as a guide for the majority of those entrepreneurs who want to sell but haven’t planned out their moves.

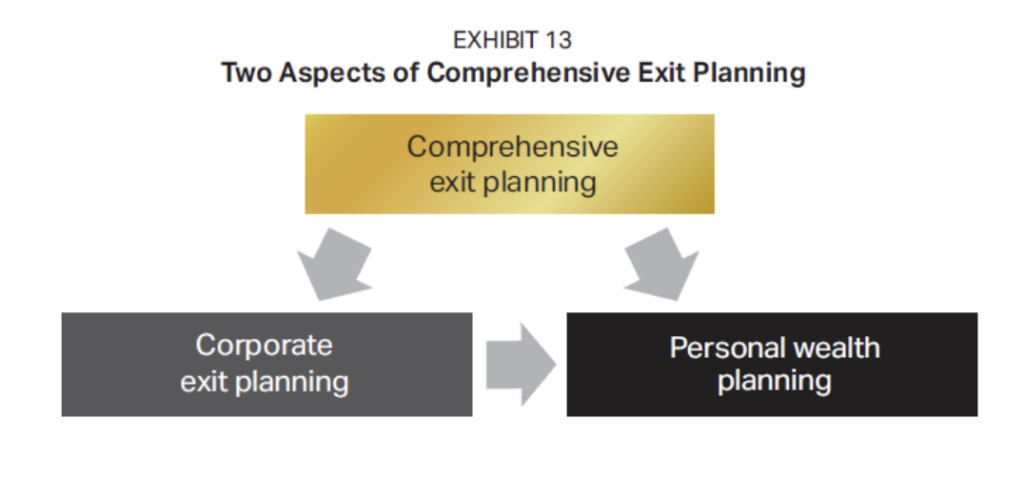

We see that the business owners who do have plans are focused on smart, comprehensive exit planning that entails two important areas: corporate planning and personal wealth planning (see Exhibit 13). A strategy that addresses both these considerations often generates the best possible results for business owners and the highest value for their companies.

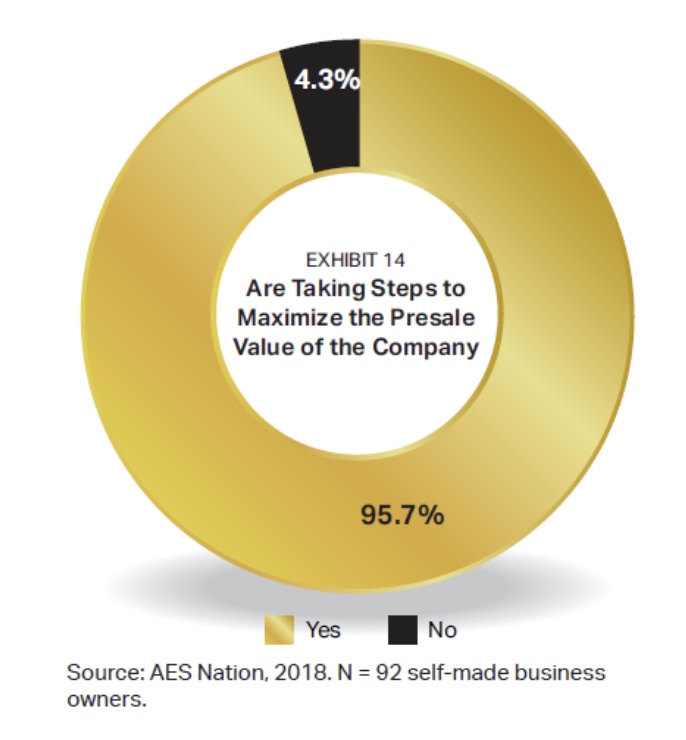

The good news is that nearly all of the business owners with transition plans—95.7 percent—engage in corporate exit planning (see Exhibit 14).

This means they are taking proactive steps aimed at making their companies more appealing to potential buyers—and getting a higher sales price. Of the many steps to take, some of the most common and impactful are:

Note: Often these and similar actions are done in partnership with professionals such as attorneys and investment bankers. Obviously, it is in all these parties’ interests to make the company as sale-worthy as possible.

This is all about maximizing and protecting personal wealth when selling privately held companies, taking into account preferences and requirements. It takes all the elements of corporate exit planning and includes a central focus on family wealth in order to achieve optimal results.

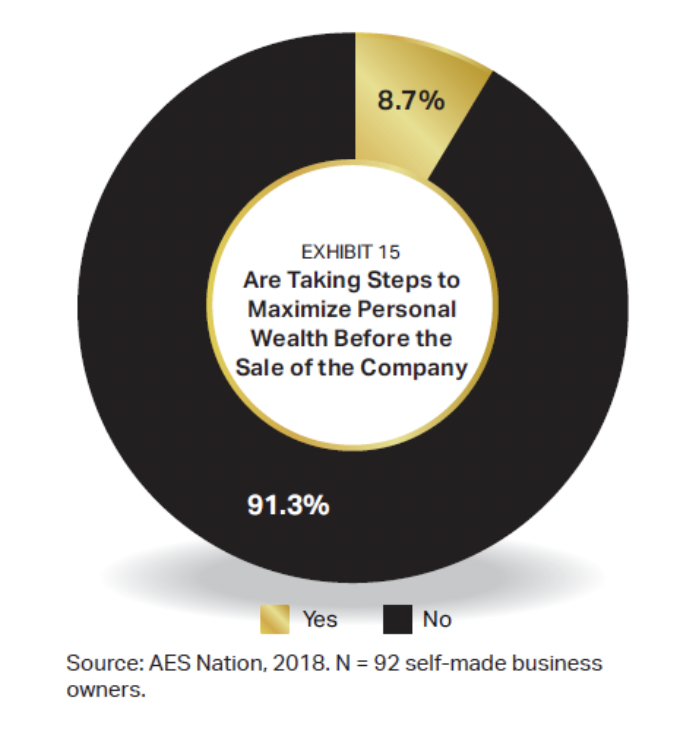

Unfortunately, here is where we see entrepreneurs falter and miss a major opportunity. Consider that less than 10 percent are taking steps to maximize their family’s personal wealth before the sale of their company (see Exhibit 15).

As a result, these entrepreneurs risk unnecessarily leaving a lot of money on the table when they sell. Sure, they might get a big sale price because of the corporate planning they’ve done. But if a lack of personal wealth planning exposes them to taxes that quickly eat into the sale proceeds, they can still end up walking away with far less than they should.

Some proactive steps to consider taking on the personal wealth side of the equation include:

Example: If the entrepreneur is philanthropic, selling the company (or a portion of it) through a charitable trust might be an option that eliminates some taxes. Other types of trusts can potentially limit future estate taxes.

Important: Being proactive by planning in advance is crucial. It’s not at all uncommon for business owners who are weeks or even days away from a sale to start asking about estate and other taxes—at which point they generally are told that it’s too late to do anything.

Given all the moving parts and complexities that can accompany the sale of a business, a team of highly skilled professionals is often needed for business owners to come away from a sale with the most after-tax wealth possible.

Two key members of that team should be a wealth manager and a tax professional. It can be a big jump going from a largely illiquid financial situation (with all assets tied up in a business) to suddenly having a sizable amount of liquid assets post-sale. These professionals can be instrumental in helping former business owners manage their newly realized wealth—taking advantage of financial opportunities, addressing financial challenges, mitigating taxes and so on.

The team is also likely to include:

If you’re a business owner who is approaching the sale of your business and you already have highly capable talent lined up to help you come away with maximum wealth, congratulations! You may very well be set up for success.

If you don’t—or if you’re not quite sure about the capabilities of your team members and you want some guidance—consider reaching out to an elite wealth manager* who has both the necessary capabilities and the relationships with the types of experts needed to guide you through the transaction.

Contact your financial professional to discuss any issues or concerns you might have around selling your company, or preparing to sell it down the road, and how you might maximize your wealth post-sale.

* Disclosure: We define elite wealth managers as financial advisors with at least five years of experience who offer one or more of the following services along with investment management: tax mitigation, business planning, wealth transfer, asset protection and charitable giving. Typically, elite wealth manager deliver these services in conjunction with one or more specialists in a given area

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.