Posted on: December 1st, 2019

Americans—especially the affluent—are some of the most charitable people in the world.* Chances are, you use some of your wealth to support favorite causes or organizations that are important to you.

Unfortunately, your contributions may not be having as big an impact as they could—and you could be missing out on some valuable charitable tax benefits that may help both you and your favorite charities.

Here’s how to size up the effectiveness of your giving—along with some strategies that could potentially put some real power behind your philanthropy.

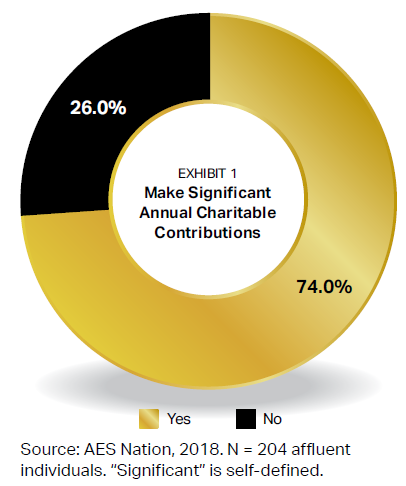

In a survey of 204 affluent individuals (those with investable assets of $500,000 or more), about three-quarters said they make significant charitable contributions every year (see Exhibit 1).

* Karl Zinsmeister, The Almanac of American Philanthropy, The Philanthropy Roundtable, 2017.

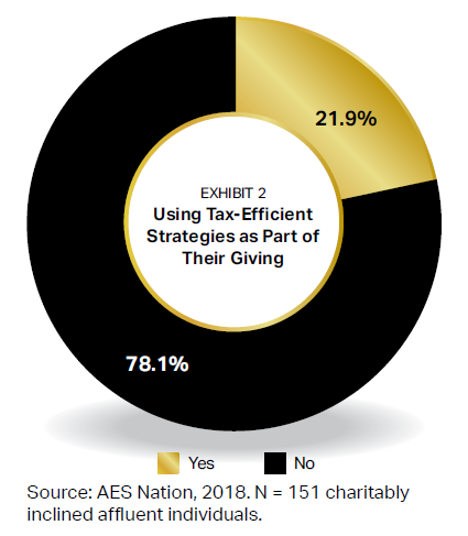

However, few of those donors are using tax-efficient strategies as part of their annual giving efforts (see Exhibit 2). In fact, only about one in five is doing more than simply writing checks to charitable organizations each year.

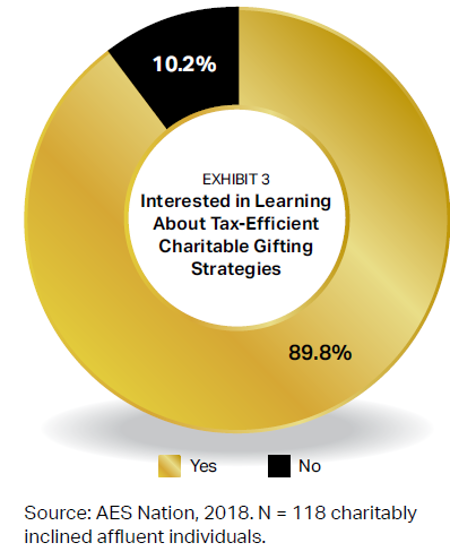

The good news: There is strong interest among the affluent to learn more about ways to give more strategically and more tax-efficiently (see Exhibit 3). The reason for the gap between interest in tax-efficient giving strategies and the use of such strategies is likely that affluent donors aren’t being educated enough about alternative ways to give.

Simply put, tax-wise charitable planning is the process of making a significant charitable gift (either during the person’s life or at death) that is part of a financial or estate plan—and doing so as tax-efficiently as possible.

Tax-wise charitable planning is usually best accomplished as part of an overall wealth plan that addresses other key issues such as wealth transfer, wealth protection and cash flow needs. When affluent donors can take into account the various assets they have and how they are structured, there is the potential to make meaningful charitable gifts that also provide meaningful tax benefits. Generally, proactive wealth planning that takes an affluent donor’s broader financial situation into account can lead to much better outcomes than can so-called checkbook philanthropy, in which charitable gifts are made out of cash flow.

Important: Effective tax-wise charitable planning focuses first on a person’s philanthropic agenda and then on how to be as tax-efficient as possible (see Exhibit 4). The intention to use wealth to achieve charitable goals is the most important component of the process.

There are many ways, beyond simply writing checks regularly, to make charitable gifts. Three of the more commonly used approaches are:

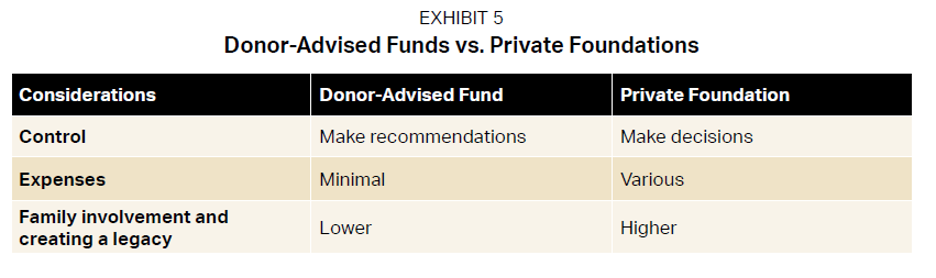

Exhibit 5 compares private foundations and donor-advised funds—two of the options more commonly used by philanthropically motivated individuals—on key characteristics such as control, expenses, and family involvement and creating a legacy.

Some key points to keep in mind:

Making tax-wise charitable planning an integral part of your wealth planning efforts can be very beneficial. That said, it is essential that the tail does not wag the dog. The core of tax-wise charitable planning should be your desire to have an impact on one or more charities. Focusing only (or even too intensely) on tax mitigation can lead to substandard financial and philanthropic results. Unfortunately, too many professionals push the tax benefits of charitable giving and underemphasize the importance of charitable intent.

For those who want to make a difference, charitable strategies such as trusts, private foundations and donor-advised funds could be very powerful wealth management solutions—and are some of the best ways to do well by doing good.

So take some time to think about your own charitable intentions and goals, both what they are today and what they might look like down the road. Armed with that information, you can start to explore and assess various strategies for achieving tax-efficient philanthropy. An elite wealth manager may be valuable in helping you think through these and related wealth- and charitable-planning concerns.

Contact your financial professional, and consult with your tax professional, to discuss your charitable goals and how you might achieve them in tax-efficient ways.

| The potential power of a charitable trust If you are philanthropically motivated, charitable trusts can be an effective way to eliminate certain taxes, such as capital gains taxes on the sale of a privately held company or other appreciated assets. There are different types of charitable trusts. For example, one type starts with the individual putting appreciated assets into the trust. The trust sells those assets (and does so without incurring income or capital gains taxes), invests the proceeds, and pays one or more designated beneficiaries an income stream for the rest of their lives or for a set term of years. After the specified time frame or the death of the last income beneficiary, the assets that remain in the charitable trust are distributed to the designated charity (or charities). This type of charitable trust offers several potential benefits: – It converts an appreciated asset into lifetime income, without having to pay capital gains taxes on the sale. – The donor receives a partial income tax deduction on the value of the asset that is donated. – The donor (or another named beneficiary) receives an income stream for life or for a set number of years. |

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.