Posted on: July 1st, 2021

We are seeing that the level of professionalism exhibited by single-family offices serving the Super Rich (those with a net worth of $500 million or more) is on the rise. That development is having a significant influence on the state of the broader wealth management industry—and on the level of service and expertise affluent investors and families receive from their advisors.

Broadly speaking, single-family offices are formal structures set up to manage the financial and personal affairs of extremely wealthy families. Pre-Covid-19, the world of single-family offices was booming due to the tremendous growth in private wealth worldwide. While many fortunes have been adversely impacted by the pandemic, some are still growing. Moreover, a substantial percentage of wealthy families are well positioned financially to capitalize on the eventual recovery.

As we move toward that goal, there are indications that single-family offices are evolving and becoming increasingly professional. For example, we see that they are becoming better at adapting to changing economic, political and social environments. They are rethinking how they operate internally and, very importantly, how they interact with others so as to be more responsive to the wealthy families they serve. The aim is to deliver the highest level of expertise and service in the most cost-effective manner. Being able to very quickly capitalize on the plethora of business opportunities is also considered a high priority.

What does this rising professionalism entail? Central to professionalism is the adoption of best practices. With the growth in single-family offices and the considerable attention they are garnering from wealthy families (and from providers, consultants and academics), efforts are being made to benchmark what is going on in the world of single-family offices to help identify best practices.

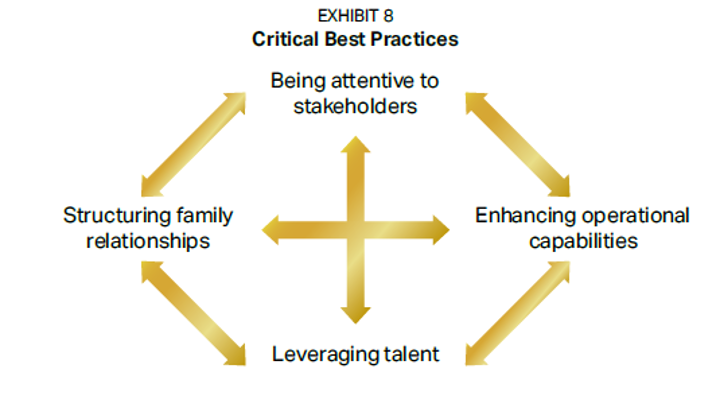

Exhibit 8 shows the interrelationships among four critical best practices that are essential to the increasing professionalism of single-family offices.

At one time, the only stakeholders in a substantial number of single-family offices were the family members—and often, just the family members who were in charge. A patriarch’s views on matters often drove everything, irrespective of the views of others who were intimately involved in and benefiting from the single-family office.

Today, there are more recognized stakeholders. Among wealthy families thinking in terms of financial dynasties, members of different generations become major stakeholders. Employees or external experts hired by the families may also be stakeholders.

All these different stakeholders have their own self-interests—and when the senior executives running the family offices develop a deep understanding of those self-interests, they can help promote better harmony between the stakeholders. The end result should be a higher level of professionalism and performance in the single-family office.

Implication for you: This trend of being highly attentive to all stakeholders and working to understand each one on a deep level is working its way into the approach used by advisors to the “merely affluent.” At lower levels of affluence, we’re seeing more discovery meetings and values-focused conversations (accompanied by values-based wealth planning).

The ability to attract and incentivize the most capable professionals is crucial to the high-performing single-family office. We see that wealthy families (and the nonfamily managers of single-family offices) are becoming more discerning about whom they engage. They want people with expertise (of course) as well as the ability to work extremely well with all the stakeholders and align all the various self-interests of the groups.

Implication for you: We are seeing that more wealth managers are able to access high-quality talent that once may have been available exclusively to the very wealthiest families. Technology is one factor here, as it enables more “boutique” providers to offer their services to wealth managers and their affluent clients in ways that make sense for those providers.

We see more single-family offices putting a lot of effort into building family cohesiveness—both to maximize the effectiveness of family wealth over time and to avoid conflicts that can damage that wealth.

This effort generally takes a number of forms, such as governance arrangements and family meetings. The goal is usually to address conflicting agendas of family members. Open lines of communication, a willingness to understand other people’s viewpoints and a desire for family cohesion are all essential elements to keeping the single-family office running well.

The way relationships with nonfamily members are structured is also very important. For example, with a large percentage of wealthy families concerned about privacy, these relationships need to operate in such a way that information about family members is well guarded through legal and other means.

Implication for you: Family legacy planning and family harmony are topics that more wealth managers are able to address today than in the past. Many wealth managers have seen how the single-family office best practice of smart family management adds value to clients’ lives, and they’re adopting these methods too.

As single-family offices become more professional, their ability to be ever more responsive to wealthy families increases. This entails putting systems and processes in place to ensure more effective responses, resulting in the delivery of consistently high-quality results.

There are a number of ways this plays out, including continuous stress testing and strategic outsourcing.

Stress testing is a process common among single-family offices that is now being embraced by a sizable percentage of the less affluent and their advisors. The goal of stress testing is to mitigate possible errors in deliverables and identify any meaningful missed opportunities. While stress testing is commonly static—conducted on demand—leading single-family offices are further systematizing the process so that it operates continually. This way, any issues that exist are quickly identified and corrected.

With greater outsourcing becoming the norm for single-family offices, the ability to effectively manage providers is paramount. This takes a number of forms, from in-depth due diligence to negotiating preferential arrangements.

Implication for you: As noted, stress testing isn’t something that only the wealthiest people do anymore. It’s becoming increasingly common when families with a smaller net worth want to ensure their wealth plans are likely to behave as they expect them to going forward. More and more wealth managers are now capable of delivering this service.

The increased professionalism in single-family offices is spreading to wealth management practices that serve affluent clients who haven’t yet achieved the wealth needed to enter the single-family-office arena. This is enabling those wealth managers to bring family office-like services and expertise to clients who may never have had access to them in the past.

It’s also allowing wealth managers to see and adopt the best practices that are helping single-family offices be more successful—which, in turn, should empower these wealth managers and their clients to pursue higher-quality results and outcomes in the years to come.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.