Posted on: August 1st, 2020

As a business owner, you’re making decisions virtually all the time. But are you making them in a thoughtful and clear-eyed way so you can really pursue optimal results?

We find that a relatively small number of accomplished entrepreneurs have what seems like an almost magical ability to size up situations and make calculated, effective decisions. Their outstanding insights are often a function of an intuitive grasp of the determining factors at work in a particular situation.

But most entrepreneurs don’t operate that way. If you’re like the vast majority of business owners, your ability to make wise decisions is based first on your ability to accurately describe the factors that shape your decision. Then, based on careful considerations, you make your decision. By gaining a solid grasp of the factors involved in determining the nature of decisions, entrepreneurs often are able to make better-informed (and therefore more meaningful) decisions.

To help you along in your quest to make smarter decisions, there are many types of decision-making support techniques. Some are straightforward; others are quite intricate.

Three of the decision-making support techniques that we see having the biggest impact on successful entrepreneurs are:

Let’s explore each one in detail and see how you can use it in your business.

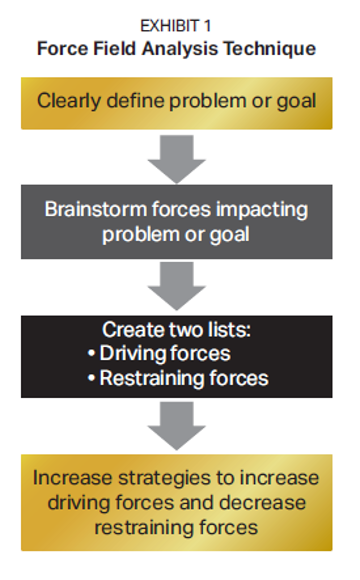

The aim of this technique—which is often used in the early stages of a business endeavor—is for the business owner and team to identify and list the forces in favor of and the forces opposed to a problem or goal.

Force field analysis helps people see differing aspects of a situation and motivates everyone to think through the ways various forces are impacting the problem or goal. It also promotes the idea that forces are either supportive or oppositional. By categorizing things this way, it becomes easier to determine strategies that would be useful to 1) strengthen the power of driving forces and 2) negate the impact of restraining forces.

Methodology: The problem or goal must first be clearly defined (see Exhibit 1). Then, the business owner and team brainstorm to specify the forces that impact the problem or goal. From here, they construct two lists: One list comprises the driving forces and the other list consists of the restraining forces. Finally, the business owner and team devise individual (and sometimes interconnected) strategies that will increase driving forces as well as those that will decrease restraining forces.

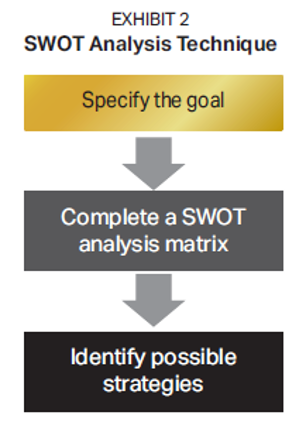

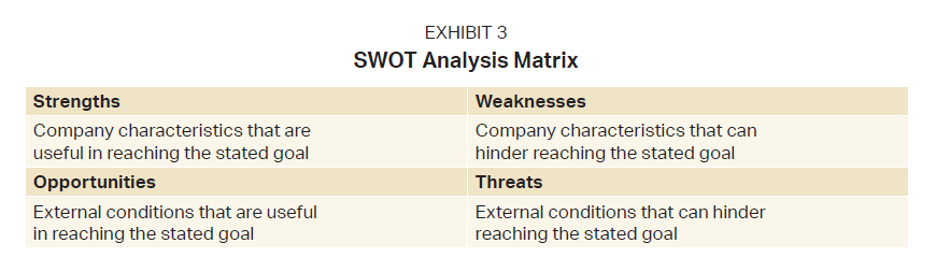

This technique is often useful when the aim is to develop a plan or strategy for a specific goal. SWOT is an acronym for:

Using this approach, the business owner and team list all the company’s strengths and weaknesses related to its ability to achieve the stated goal. Then, they list the different opportunities and threats in the external environment that could potentially impact the company’s ability to reach the stated goal.

SWOT analyses are generally easy to implement, and they often provide perspectives and insights without a great deal of effort. Commonly, we find that the outcome of a well-executed SWOT analysis is a specific course of action that can have an impact fairly quickly. As the approach is directly tied to the capabilities within a company, the derived course of action is also usually quite practical.

Methodology: Generally, SWOT analyses involve three steps (see Exhibit 2). The starting point is specifying the goal. The more concrete the stated goal, the more effective the analysis.

Then the business owner and team create a SWOT analysis matrix (see Exhibit 3). The matrix can be sparse or filled with a great amount of material, depending on the complexity of the issue at hand.

Lastly, the business owner and team identify possible strategies for achieving the stated goal. Often, reviewing each quadrant and addressing the content accomplishes this. The following questions can be useful in this regard:

All too often, business owners jump to conclusions when making important decisions. This can result in poor solutions that not only fail to solve the problem but also can cause further complications to address.

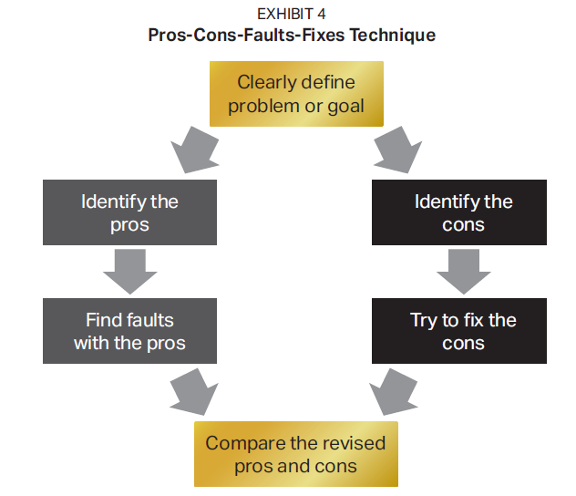

The pros-cons-faults-fixes technique is often very effective in shutting down this tendency. The approach does not show which of two sides—the pros or the cons—has the strongest argument. Instead, the business owner and team determine the final answer. The technique helps organize the problem logically and helps ensure that people carefully think through possibilities by being objective instead of emotional.

Methodology: The starting point is to clearly detail a proposed course of action (see Exhibit 4). Then the business owner and team list the pros in favor of the decision and cons against the decision. The pros are the many anticipated advantages and benefits of enacting the decision, while the cons are all the possible reasons the decision will turn out bad.

Next, the business owner and team examine each con to see whether it can be fixed, which entails coming up with ways to mitigate any adverse effects and possibly making the con a pro. Also, the business owner and team look to see whether they can find faults with the pros. For example, they might ask: How could the pro not work out as anticipated, and what are the negative consequences if that is indeed the case?

Lastly, the business owner and team weigh their findings and conclusions. The final decision is based on the judgment of the business owner and team, who (ideally) now have a better and more comprehensive understanding of the proposed decision.

We don’t know many business owners who couldn’t use some help from time to time when it comes to making better decisions—especially about mission-critical issues affecting their enterprises. Techniques such as the three profiled above have proven to be very helpful in enabling business owners and their teams to do a better job of attaining their goals and addressing problems.

That said, these techniques don’t guarantee superior outcomes. But they may help offset some of the very human failings and mistakes many of us make when we aim to make smart decisions.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.